First Time Home Buyer 401k Withdrawal 2024 Irs Deadline – They don’t get to delay an RMD to April 1, 2024, because they already took their first keep this tax deadline in mind if you took large withdrawals from tax-deferred retirement savings . The 2024 tax filing season is officially open. Here are the changes to know about, particularly for remote workers and Canadians saving for their first home. .

First Time Home Buyer 401k Withdrawal 2024 Irs Deadline

Source : www.fool.comSafe Way Tax Service LLC | Conway AR

Source : www.facebook.com401k Contribution Limits For 2024

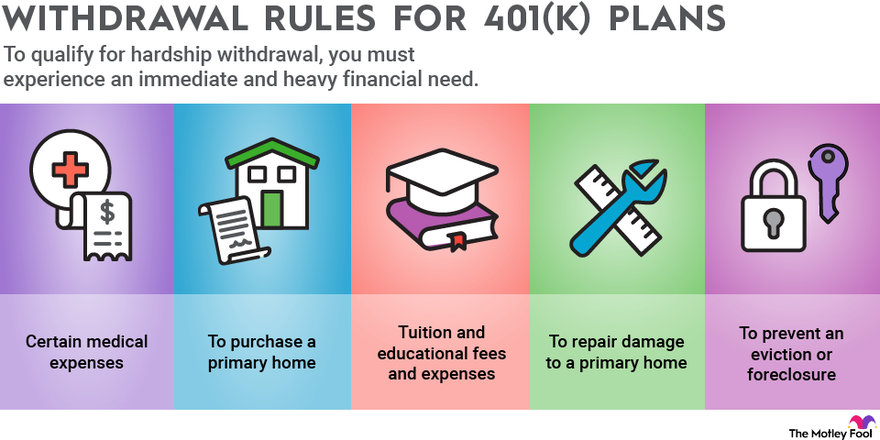

Source : thecollegeinvestor.comRules for 401(k) Withdrawals | The Motley Fool

Source : www.fool.comRoth IRA: Benefits, Rules, and Contribution Limits 2024

Source : districtcapitalmanagement.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

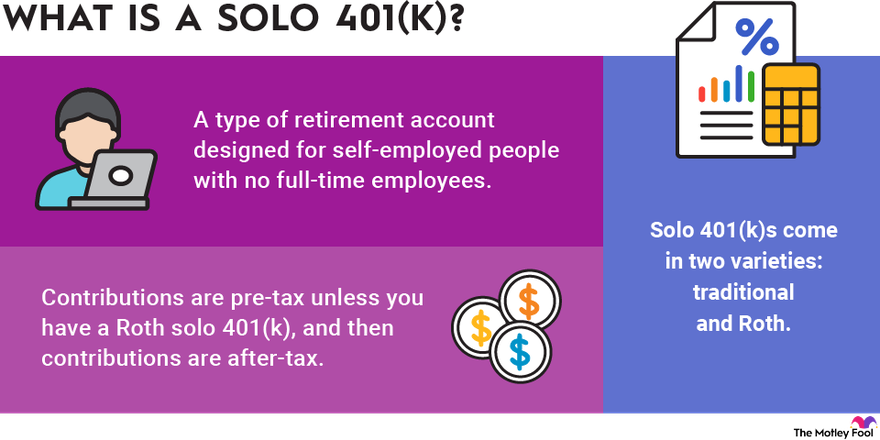

Source : thecollegeinvestor.comWhat Is a Solo 401(k)? | The Motley Fool

Source : www.fool.comIRA Required Minimum Distributions Table 2023 2024 | Bankrate

Source : www.bankrate.comFederal Income Tax Deadline in 2024 | SmartAsset

Source : smartasset.comMyTaxFiler | Plano TX

Source : www.facebook.comFirst Time Home Buyer 401k Withdrawal 2024 Irs Deadline 6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool: However, the first-time home buyer tax credit expired in 2010. Last year, there were a few efforts in Congress to reinstate a similar home-purchase incentive, but so far in 2024, no new tax credit . By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments .

]]>